What Is The Estate Tax Exemption For 2025

What Is The Estate Tax Exemption For 2025. In addition to the federal gift and estate tax,. The internal revenue service recently announced that the federal estate and gift tax exemption amounts will be $13.99 million per individual for gifts and deaths occurring in.

Looking forward to 2025, the irs recently announced that the annual gift tax exclusion will increase to $19,000 per individual, while the lifetime estate and gift tax exemption will rise. Effective january 1, 2025, you will be.

What Is The Estate Tax Exemption For 2025 Images References :

Source: www.kiplinger.com

Source: www.kiplinger.com

2023 Estate Tax Exemption Amount Increases Kiplinger, Learn how to prepare now.

Source: legacygroupny.com

Source: legacygroupny.com

Estate Tax Exemption Changes Coming in 2026 Estate Planning, This means, with proper planning, a married couple can shield a total of.

Source: www.nauticawealthadvisors.com

Source: www.nauticawealthadvisors.com

Change on the Horizon Preparing for the Estate and Gift Lifetime Tax, The irs has announced a higher estate and gift tax exemption for 2025.

Source: learningschoolhappybrafd.z4.web.core.windows.net

Source: learningschoolhappybrafd.z4.web.core.windows.net

Estate Tax 2022 Exemption, Beginning on january 1, 2025, the federal estate, gift and gst tax exemptions will be $13,990,000 per taxpayer, an increase of $380,000 from 2024.

Source: mashaqjulina.pages.dev

Source: mashaqjulina.pages.dev

2024 Estate Tax Exemption Irs Andra Blanche, However, 2025 will be a pivotal tax year.

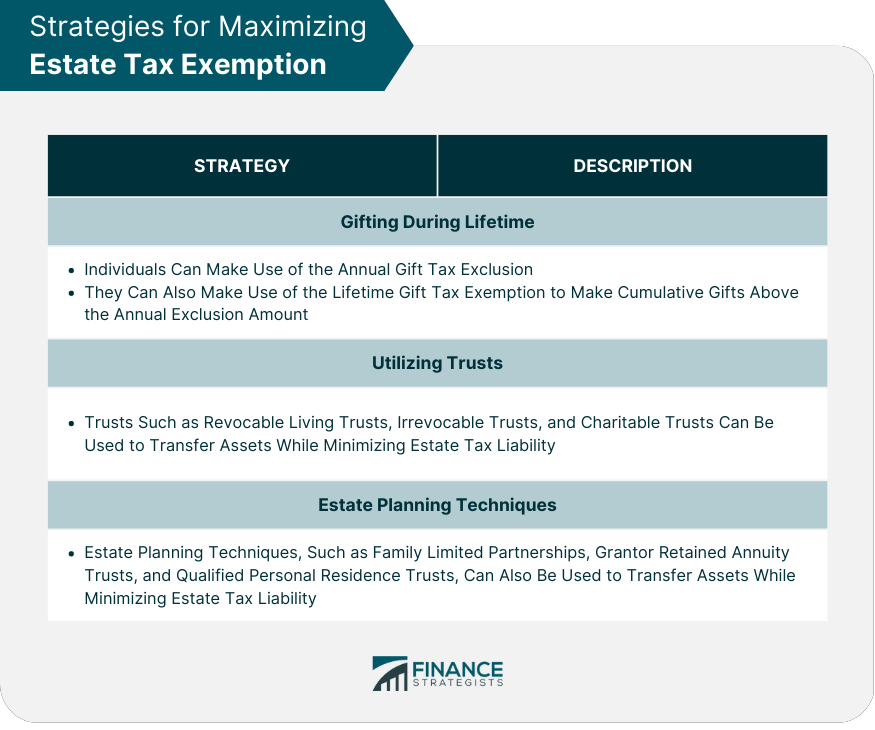

Source: www.financestrategists.com

Source: www.financestrategists.com

Estate Tax Exemption Definition, Thresholds, and Strategies, As adjusted for inflation, the exemption amount will likely fall around $7,000,000 or so.

Source: wynnejillie.pages.dev

Source: wynnejillie.pages.dev

Estate Tax Exemption 2025 Paige Barbabra, The lifetime exemption is shared between gifts made during.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Estate Tax Exemption Amounts And Tax Rates, Unprecedented opportunities the lifetime estate and gift tax exemption will rise to $13.99 million per individual in 2025, up from $13.61.

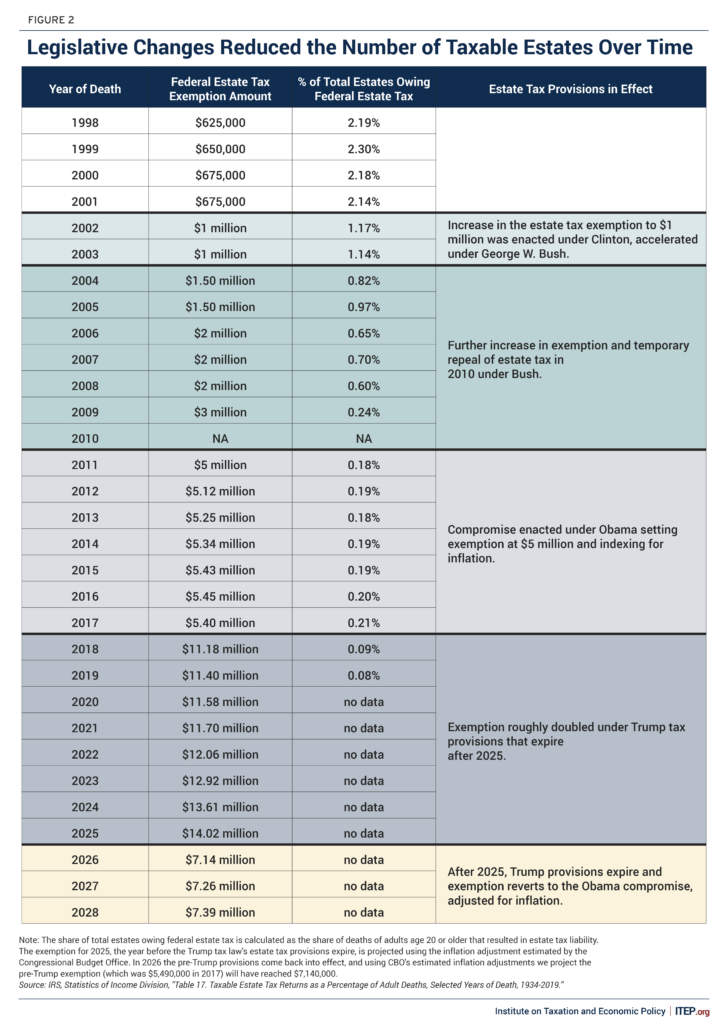

Source: itep.org

Source: itep.org

The Estate Tax is Irrelevant to More Than 99 Percent of Americans ITEP, The combined gift and estate tax lifetime exemption will be $13.99 million per individual for lifetime gifts made in 2025 and for bequests made by a person who passes away.

Source: legacygroupny.com

Source: legacygroupny.com

Estate Tax Exemption Changes Coming in 2026 Estate Planning, Unprecedented opportunities the lifetime estate and gift tax exemption will rise to $13.99 million per individual in 2025, up from $13.61.