Standard Deduction 2026 Single

Standard Deduction 2026 Single. One other popular item that may be changing back to 2017 levels is the standard deduction which was increased across the board. When calculating taxable income, taxpayers may deduct the standard deduction from adjusted gross income (agi) or elect to itemize.

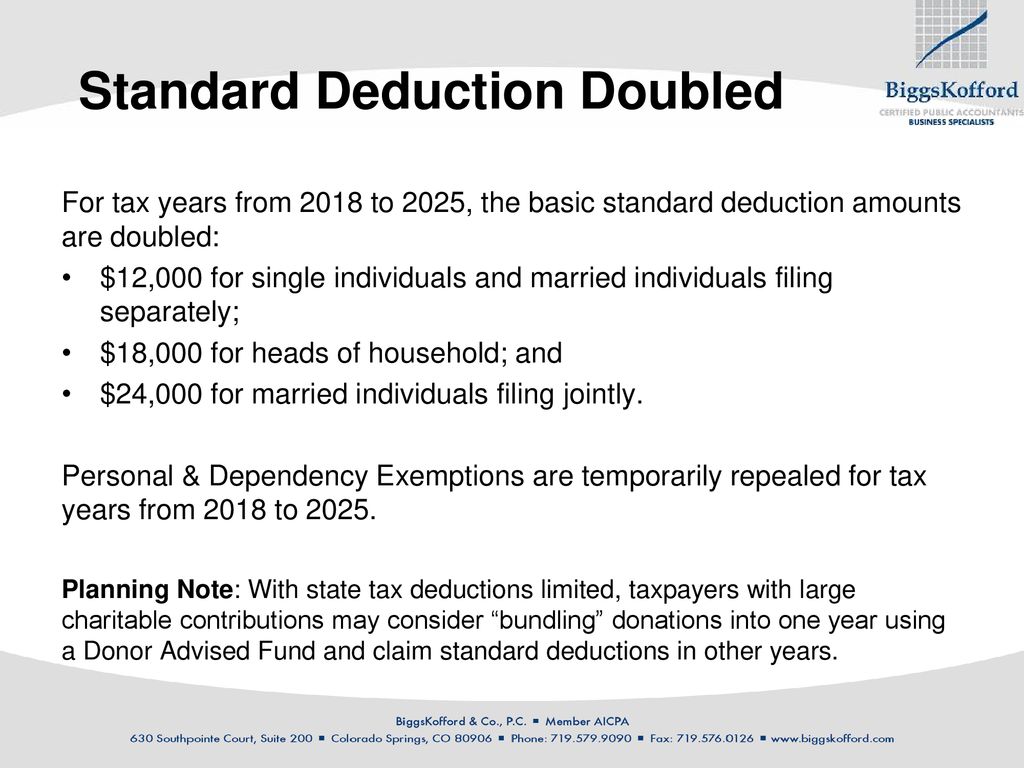

The standard deduction for taxpayers younger than age 65, currently $14,600 (single) and $29,200 (married filing jointly), is expected to decline to $8,300 and $16,600, respectively, according to. The standard deduction would shrink, and be valued at $8,350 for single filers, $16,700 for joint filers, and $12,250 for head of household filers, compared to $15,450, $30,850, and $23,150, respectively, if the tcja instead.

Standard Deduction 2026 Single Images References :

Source: kallibroanne.pages.dev

Source: kallibroanne.pages.dev

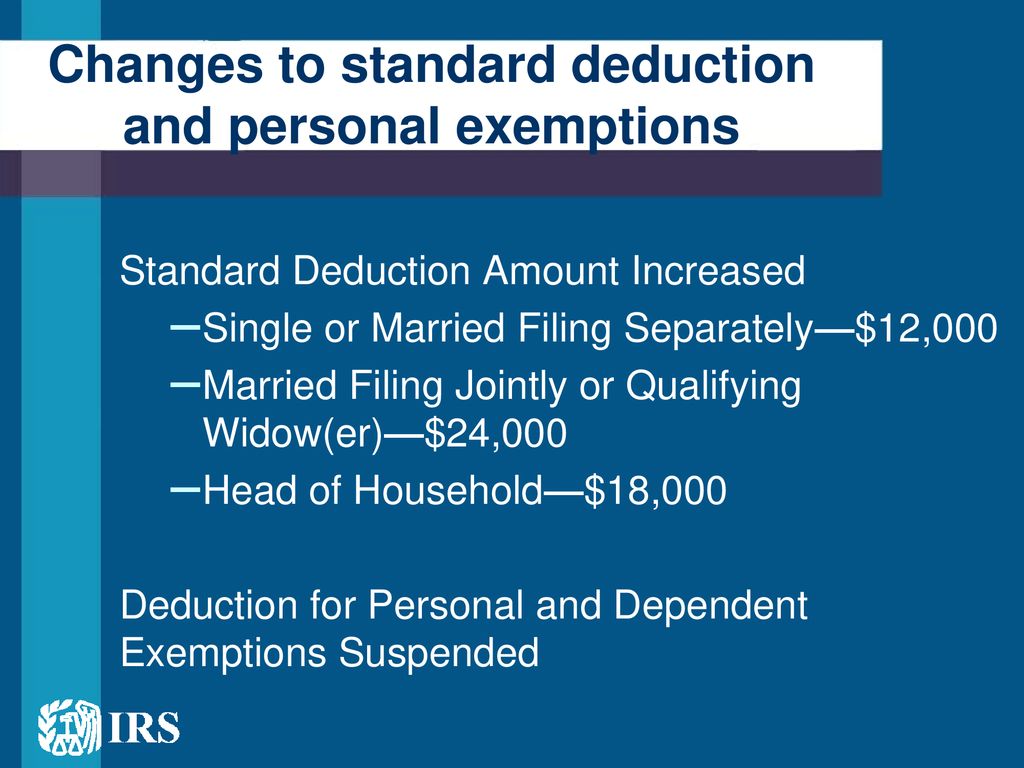

2024 Tax Tables And Standard Deductions Calculator Monah Eleanora, After the tcja was enacted, the standard deduction caps were doubled to $12,000 for single filers, $18,000 for heads of household, and $24,000 for married people filing together.

Source: brookqallyson.pages.dev

Source: brookqallyson.pages.dev

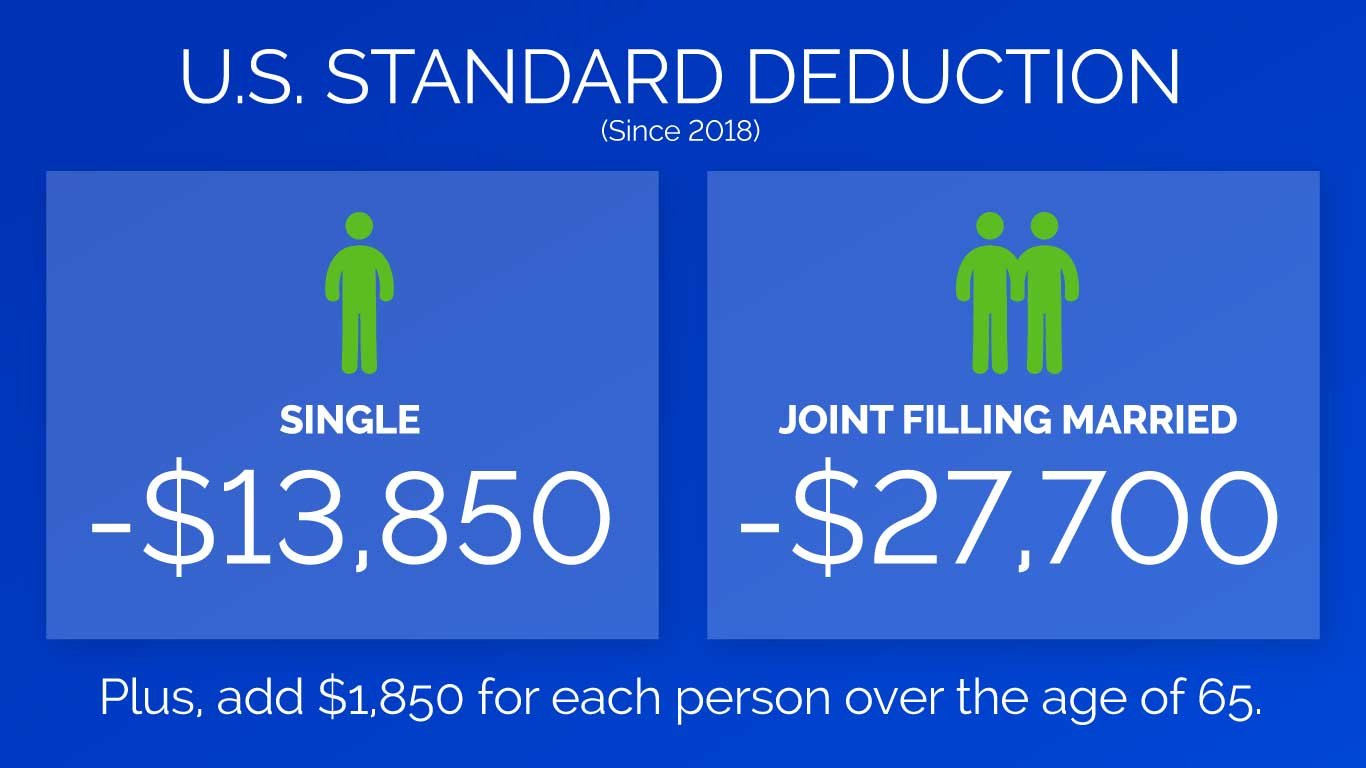

Tax Brackets 2024 Married Jointly Standard Deduction Avie Margit, The higher standard deduction will revert to lower amounts, dropping from $13,850 to $6,500 for single filers and from $27,700 to $13,000 for married.

Source: oakharvestfg.com

Source: oakharvestfg.com

IRS Tax Brackets AND Standard Deductions Increased for 2023, The standard deduction for the 2025 tax year (tax returns filed in 2026) is $15,000 for single filers and married people filing separately, $22,500 for heads of household, and.

Source: aerielyleontyne.pages.dev

Source: aerielyleontyne.pages.dev

2024 Tax Standard Deduction Amount Aurea Caressa, The current estimate for 2026 is a $5,300 deduction per individual, spouse, and dependent.

Source: elvinahjkjuanita.pages.dev

Source: elvinahjkjuanita.pages.dev

2025 Standard Deduction For Single Over 65 Tamar Anestassia, Standard deduction to drop, personal exemptions return.

Source: elvinahjkjuanita.pages.dev

Source: elvinahjkjuanita.pages.dev

2025 Standard Deduction For Single Over 65 Tamar Anestassia, The standard deduction is expected to go down.

Source: faithasecatharine.pages.dev

Source: faithasecatharine.pages.dev

2025 Standard Deduction Head Of Household 2025 Agna Lorain, For single folks without dependents, the two deductions will result in approximately.

Source: jeanneasemargeaux.pages.dev

Source: jeanneasemargeaux.pages.dev

What Is The Standard Deduction For 2025 Taxes Danya Gabrila, Standard deduction (irc § 63):

Source: faithasecatharine.pages.dev

Source: faithasecatharine.pages.dev

2025 Standard Deduction Head Of Household 2025 Agna Lorain, Under the tcja, standard deduction totals were nearly twice that of 2017’s numbers.

Source: faithasecatharine.pages.dev

Source: faithasecatharine.pages.dev

2025 Standard Deduction Head Of Household 2025 Agna Lorain, For 2024, the standard deduction amounts are $29,200 for married filing jointly, and $14,600 for single filers.