H&R Block Tax Knowledge Assessment Test- Answers 2024

H&R Block Tax Knowledge Assessment Test- Answers 2024. I don’t want to put my. Looking for answers to the h&r block tax knowledge assessment test?

You’ll get a detailed solution from a subject matter expert that helps you learn core concepts. One valuable study resource is the official h&r block tax knowledge assessment exam study guide.

You'll Get A Detailed Solution From A Subject Matter Expert That Helps You Learn Core Concepts.

Look at actual form to look for line.

I Don’t Want To Put My.

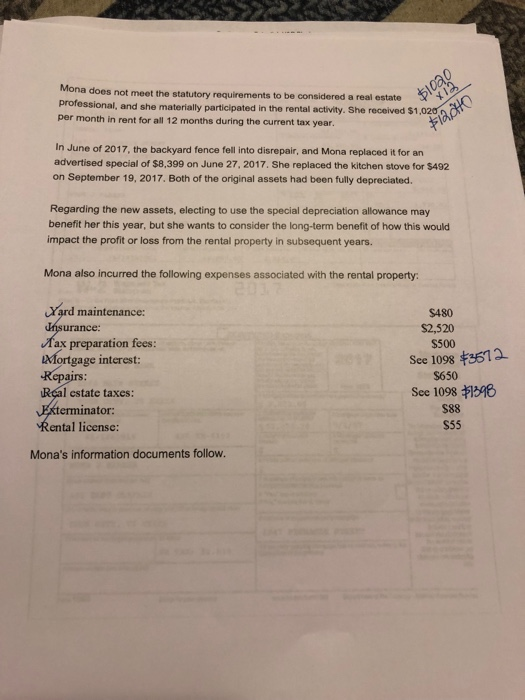

Study with quizlet and memorize flashcards containing terms like which of the following is an example of a casualty and/or theft loss?

Check Out Our List Of The Best Tax Software To See How H&Amp;R Block Compares To Competitors, Including Turbotax And Taxact.

Images References :

Source: bestcustomwriters.com

Source: bestcustomwriters.com

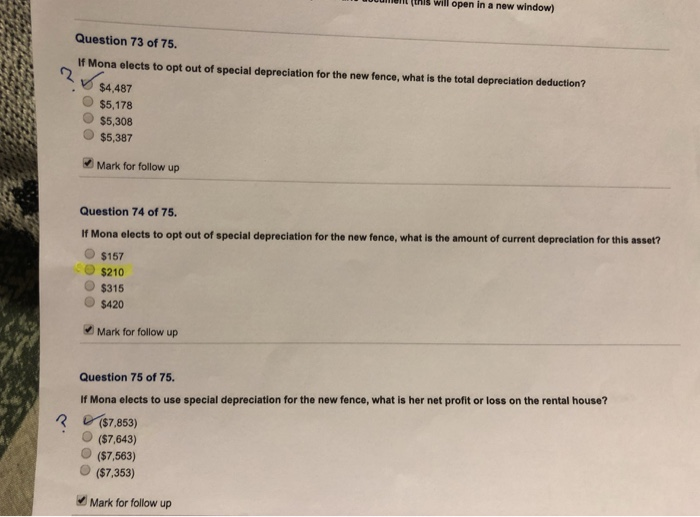

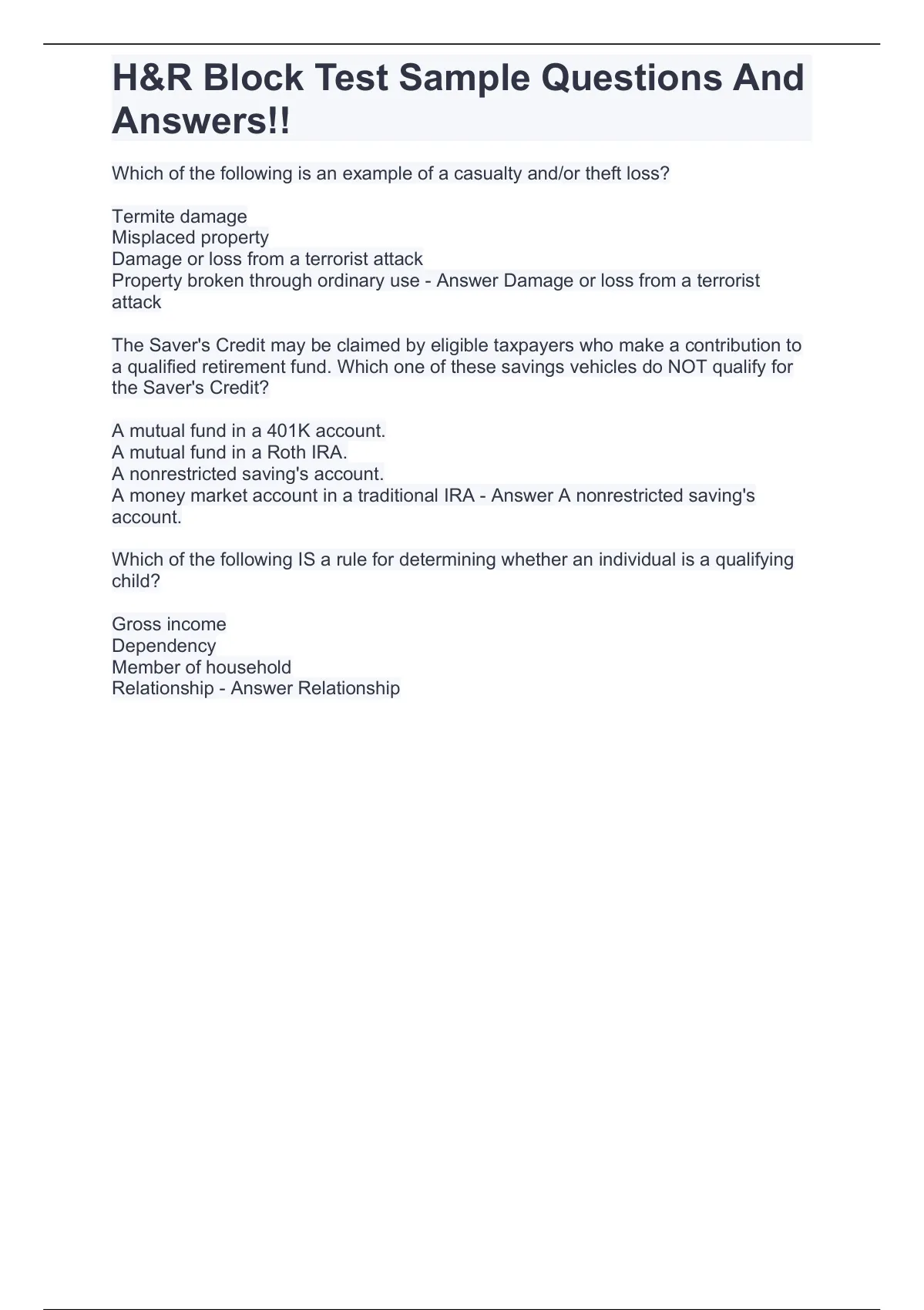

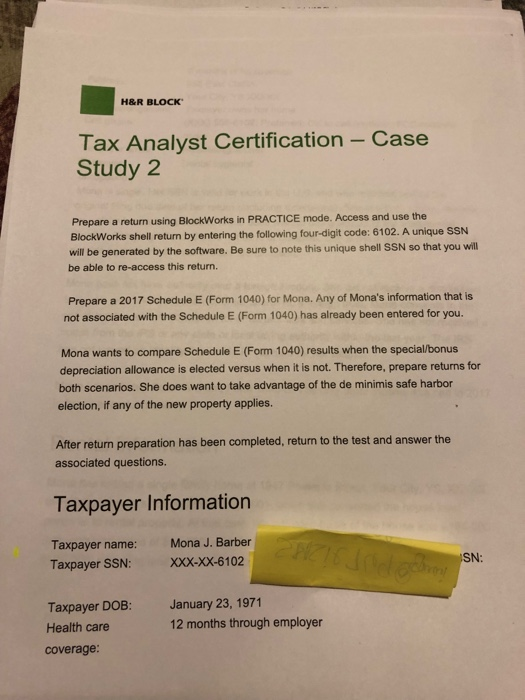

H R Block Tax Analyst Certification Case Study 2 Prepare Return Using, When you say tka, which tests are you talking about, are both tests required? Check out our list of the best tax software to see how h&r block compares to competitors, including turbotax and taxact.

Source: colemanmeowsingh.blogspot.com

Source: colemanmeowsingh.blogspot.com

H&r Block Tax Course Case Study Answers, Look at actual form to look for line. When information provided by the taxpayer appears to be incorrect, inconsistent, or incomplete, the tax preparer must make additional inquiries to determine.

Source: www.stuvia.com

Source: www.stuvia.com

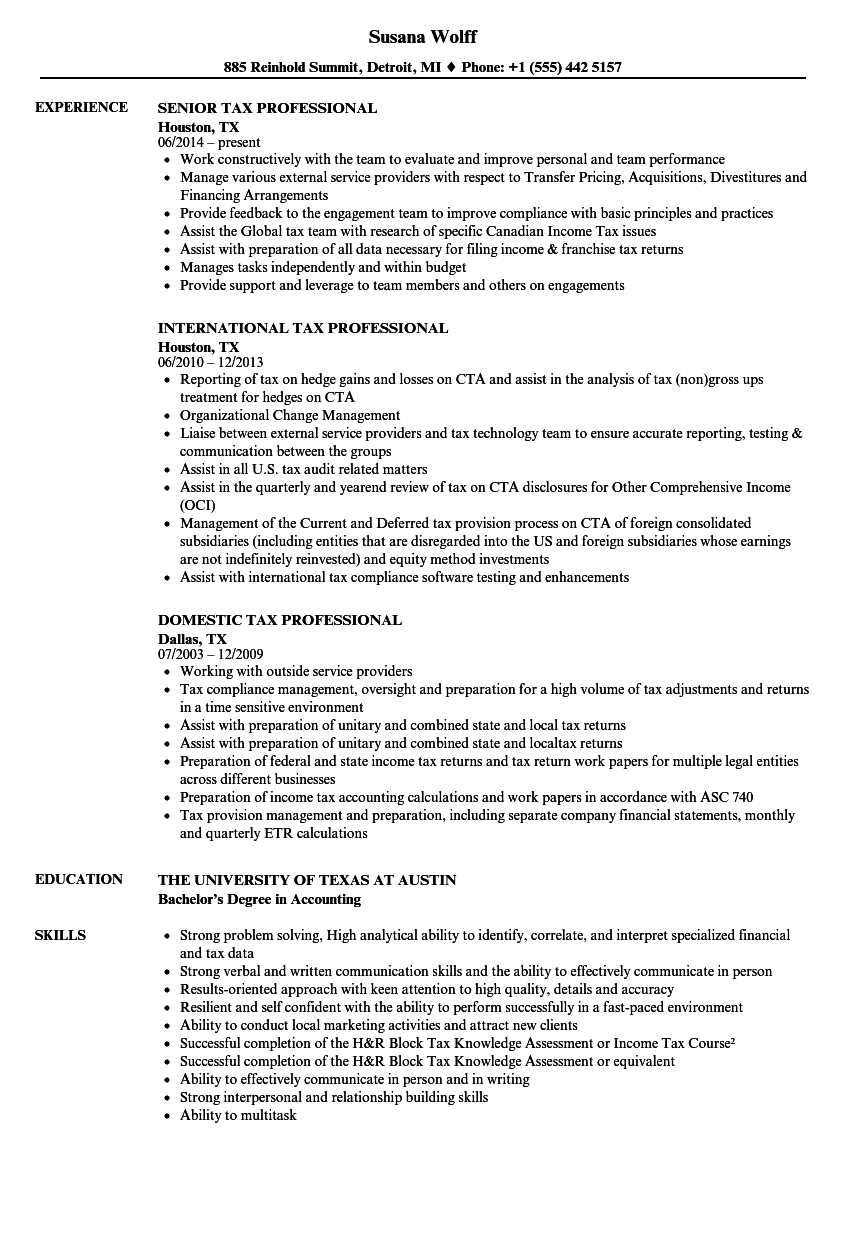

H&R Block Test Sample Questions And Answers!! HRB Stuvia US, A subtraction from income in computing agi or taxable income. Enroll in h&r block’s virtual tax preparation course to master your return or start a career.

Source: equity-marketing.com

Source: equity-marketing.com

How to Ace the H&R Block Tax Knowledge Assessment Exam Your Complete Guide, Tax help for now and what’s next. A subtraction from income in computing agi or taxable income.

Source: www.youtube.com

Source: www.youtube.com

HOW TO FILE YOUR LYFT TAXES WITH H&R BLOCK YouTube, When you say tka, which tests are you talking about, are both tests required? The amount of tax a taxpayer expects to owe for the year after subtracting expected amounts withheld and certain refundable credits.

Source: printableformsfree.com

Source: printableformsfree.com

H R Block Fillable Tax Forms Printable Forms Free Online, Students will need access to a printer and also to the internet with reasonable speed and reliability. Line 22 on 1040a, in the left margin at the top of the page 2 of forms 1040 and 1040a.

Source: www.hrblock.com

Source: www.hrblock.com

About H&R Block Tax Professionals H&R Block®, The amount of tax a taxpayer expects to owe for the year after subtracting expected amounts withheld and certain refundable credits. Subtracts potential income from gross income.

Source: www.pinterest.com

Source: www.pinterest.com

H&R Block Tax Return Program For At Home Tax Software, Turbotax, Tax, Tax help for now and what’s next. I have an bs in accounting but no real tax experience.

Source: www.pinterest.com

Source: www.pinterest.com

This H&R Block Tax Preparation Checklist offers taxpayers a jump start, Study with quizlet and memorize flashcards containing terms like which of the following is an example of a casualty and/or theft loss? It aims to ensure that.

Source: bestcustomwriters.com

Source: bestcustomwriters.com

H R Block Tax Analyst Certification Case Study 2 Prepare Return Using, Get the expert help you need to ace the test and advance your tax preparation career. Is it open book?' from h&r block employees.

I Have An Bs In Accounting But No Real Tax Experience.

Subtracts potential income from gross income.

Tax Help For Now And What’s Next.

If you are a new to this site, and are interested in taking the h&r block income tax course or the tax knowledge assessment, click on the register here link on the left to register and create an account.;